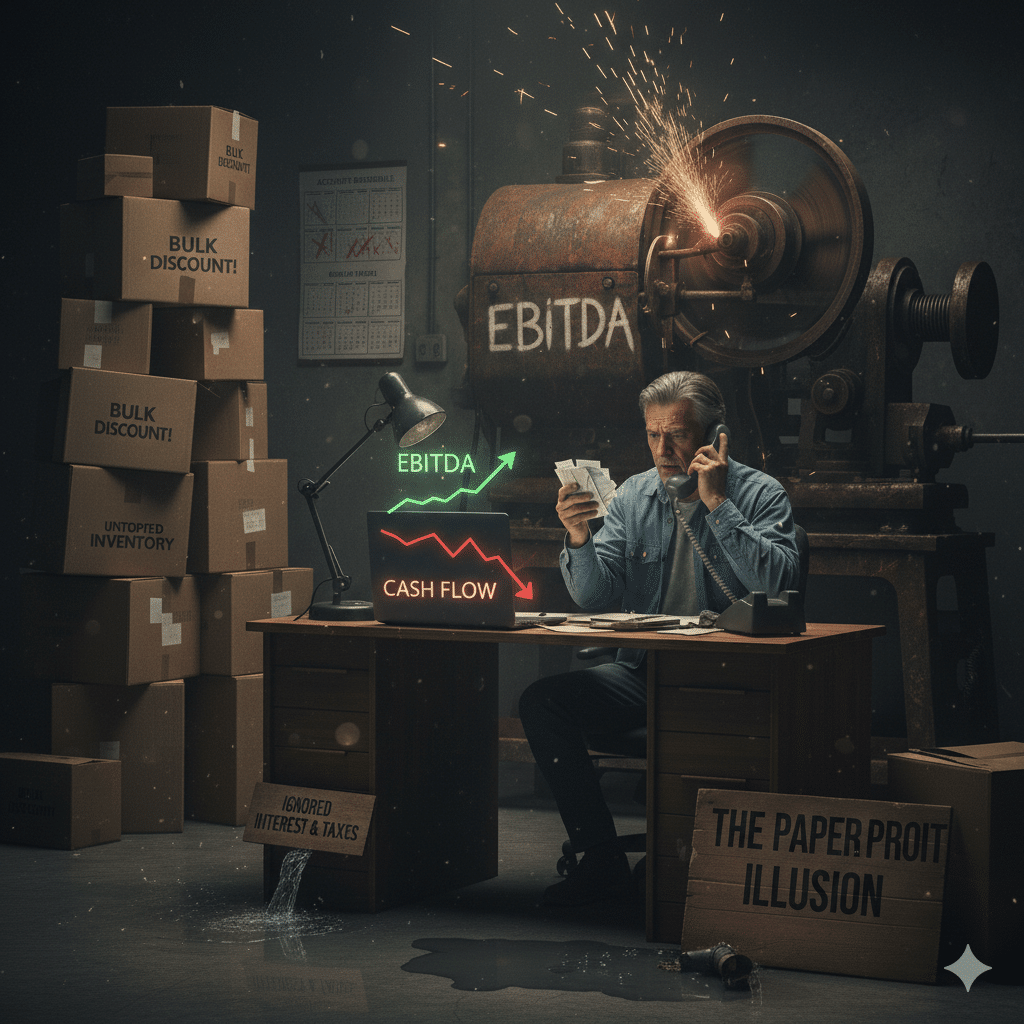

How EBITDA Destroys Small Businesses

A healthy P&L is a common trap for business owners. They see growing EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and assume the business is thriving. They confuse profitability with liquidity and spend money only to find the bank account empty when payroll is due.

EBITDA is a non-GAAP, hybrid profit measure. In sub-$5M businesses, EBITDA is a vanity metric that masks the operational reality. Here is why focusing on it over cash flow leads to tragic outcomes.

The Paper Profit Illusion

EBITDA is an accounting metric, not a bank balance. It includes revenue that has been invoiced but not yet collected (Accounts Receivable).

- The Tragic Decision: An owner sees a high EBITDA and decides to double down on marketing spend or hire new staff.

- The Reality: If customers are taking 60–90 days to pay, the owner is essentially financing their customers’ businesses while starving their own. You can literally grow yourself into bankruptcy by chasing EBITDA-positive sales that drain your cash reserves.

Ignoring Interest and Taxes

The “IT” in EBITDA matters immensely for small businesses. $20M companies have deep lines of credit, while a $3M company often relies on high-interest equipment loans and personal guarantees.

- The Tragic Decision: An owner overcommits resources because EBITDA looks great.

- The Reality: Interest and taxes are real cash outflows. If your EBITDA is 15% but your interest and tax obligations with debt service eat up 14%, you have zero margin for error. One bad month and you are in loan default.

The CapEx Blind Spot

EBITDA conveniently ignores Depreciation and Amortization. While these are non-cash accounting entries, they represent the very real need to replace equipment, software, or vehicles.

- The Tragic Decision: The owner reinvests profits into new equipment or lifestyle upgrades because the EBITDA suggests the business is a cash cow.

- The Reality: When a critical piece of machinery breaks, there are no cash reserves for major repairs or replacement because the profit was fiction that didn’t account for the physical wear and tear of assets.

Working Capital Neglect

EBITDA doesn’t account for when money moves in or out of your business or the cash tied up in Inventory.

- The Tragic Decision: Buying overstock to get a bulk discount that improves margins.

- The Reality: That capital is now sitting in the warehouse. If sales volume slows, the business has cash tied up and must borrow to make payroll.

The Peer Perspective

The focus on EBITDA can push an otherwise profitable company towards insolvency. Cash flow is what you use to run a successful business, regardless of size.

If you’re under $5M, your goal is staying in the game, and you can’t pay employees with Earnings Before Everything. Cash from operations determines survival and funds growth.